Comments: The Gold Bugs Index continues flirting with a breakout from the triangle pattern. RSI momentum indicator has broken its downtrend but has headed sideways since. There are two obstacles to a breakout: (1) Gold seasonality tends to be rather bearish until the first days of September, and (2) because sales have lagged this year considerably below the 500 tonne annual limit under the Central Bank Gold Agreement, it's theoretically possible that increasing quantities could be dumped on the market by Central Banks until September 26, when the limit resets.

Comments: The Gold Bugs Index continues flirting with a breakout from the triangle pattern. RSI momentum indicator has broken its downtrend but has headed sideways since. There are two obstacles to a breakout: (1) Gold seasonality tends to be rather bearish until the first days of September, and (2) because sales have lagged this year considerably below the 500 tonne annual limit under the Central Bank Gold Agreement, it's theoretically possible that increasing quantities could be dumped on the market by Central Banks until September 26, when the limit resets.

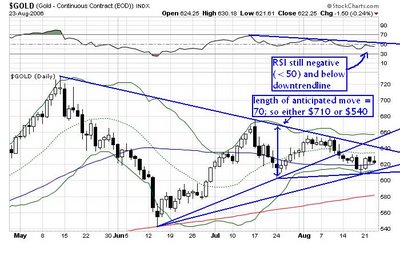

Comments: Gold continues underperforming the miners, but it is also in a triangle pattern. Owing to the more bullish posture of the miners and the upcoming stronger seasonal demand for Gold which may begin to emerge any day now, I believe that the breakout in Gold should be to the upside. In the short term, weak seasonality may take gold is low as $614 or even $610, but probably not lower on a closing basis. I do not see the HUI falling below 340.

The anticipated upside move on a bullish triangle breakout would be to $710 in Gold and around 400 on the HUI. So that would be about a 15% gain in the miners. If such move occurs, I believe it will be stopped out at the previous highs, i.e., around 400 HUI. The HUI will still likely need some time to consolidate after that. Speaking from a longer term perspective, I believe that such upside move would occur in the broader context of a longer consolidation pattern that should end towards the end of this year

In the short term, the end of this month may see a strong surge in Gold as seasonal factors will then coincide with the August 31 U.N. imposed deadline on Iran to cease enrichment activities. Those are the factors that I would look to for a bullish breakout from the triangle.

Current Exposure to PMs: 100% + some calls

Sentiment: expecting limited downside and a breakout to the upside within 1 week at the latest.

No comments:

Post a Comment