Thursday, August 31, 2006

Wednesday, August 30, 2006

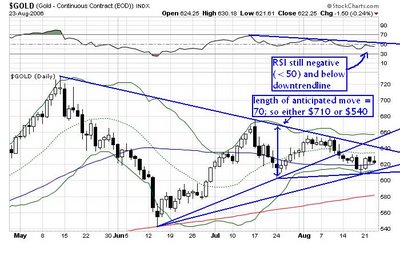

Gold Market Commentary

- Update on Yanacocha: Yesterday, I commented on the civil disturbances that had recently led to the closure of the Yanacocha mine in Peru just a few days after mining companies operating in Peru had agreed to sign a "voluntary agreement" to a provide funding for local community projects. It appears that a settlement has been reached to end the blockade of the mine which, according to mine officials had led to daily ]lost revenues of US$1.9 million and the laying off of more than 1,000 contract workers. Not surprisingly, it was reported today at Mineweb.net that "business and mining industry leaders complained that the Peruvian Government's failure to remove protestors from blocked mine roads violated the spirit of the voluntary agreement." [http://www.mineweb.net/gold_silver/977288.htm

- China Unchecked: Looks like there is no end in sight to China's continuing economic growth with the latest Chinese estimates showing that theChinesee economy grew by 10.2% in 2005, a revisionn up from the previously estimated 9.9% pace. This despite a series of measures,includingg two Central bank rate hikes, aimed at slowing this run-away train. [http://biz.yahoo.com/ap/060830/china_economy.html?.v=7

- Hurricane Season "Disappoints": It appears that tropical storm Ernesto, briefly a category 1 hurricane, fizzled out before hitting Florida after projections last week had it possibly wreaking havoc among the oil production facilities in the central and eastern portions of the Gulf of Mexico. So far, the previously promising hurricane season has "disappointed" partly leading to the current decline in oil prices. However, the worst may yet be before us as hurricane seasonality will soon hit its peak.

- Update on USGL: U.S. Gold Corp (USGL)'s listing on the Toronto Stock Exchange was recently approved and U.S. Gold Corp started trading today on the TSX under the ticker UXG. Usually new listings for gold juniors are generally associated with a surge in the share price. Mysteriously, USGL has been down about 13.5% since last Friday, including a bizarre down and up day yesterday on 6 times regular volume.

- Odd News: Finally, in odd news of the week, Iranian President Mahmoud Ahmadinejad, challenged President George W. Bush to a television debate 2 days prior to the expiration of the U.N. deadline for Iran to cease uranium enrichment activities. While the thought of Ahmadinejad going tete-a-tete with Dubya on Larry King Live may be worth a chuckle, it also makes imminent U.S. bombing strikes on August 31 a little hard to envision in the wake of such a comical development. In any case, by consistently calling for further discussions, it appears that Iran may have maneuvered skillfully enough to possibly expose the divisions between the group of Western powers and China and Russia who do not share the West's same fervor for quick and vigorous action against Iran. This may mean that the expiration of the August 31 deadline may not immediately bring the expected fireworks that may have been a major catalyst for higher Gold prices in the short term. Nevertheless, it also reinforces Iran's position and leverage in this dispute and sets it more firmly on a Gold-bullish collision course with the West in the long run. In any case, we'll soon begin to see how this issue is likely to unfold.[http://edition.cnn.com/2006/WORLD/meast/08/29/iran.nuclear/index.html]

Tuesday, August 29, 2006

Feeling the Love at Yanacocha

On one hand mining companies operating in Peru, including NEM and BVN, agreed on August 24 to make "voluntary" windfall profit payments in the total amount of US$774 million which will be used to fund various community social programs as a result of negotiations with the administration of newly elected President Alan Garcia, which negotiations were headed on the miners' side by BVN Chief Executive Roque Benavides who complained that the negotiations were being conducted "under pressure".

On the other hand, four days later, mine officials had to announce the suspension of all operations at the Yanacocha gold mine, the largest gold mine in Latin America, which is operated by NEM and jointly owned by NEM and BVN, due to local farmer protests who are complaining that the mine is poisoning the neighboring streams while, at the same time, demanding that the mine's owners provide them with more jobs at the mine. Mine officials have demanded that the government act to clear the roadway to the mine, which is being blocked by some 90 protesters, but apparently, the officials are unwilling to act because they are wary of needlessly upsetting the locals.

Related Articles:

"Major Peru Gold Mine Suspends Production"

[http://biz.yahoo.com/ap/060828/peru_gold_mine.html?.v=2]

"Miners to pay Peru $774 mln to avoid new royalty"

[http://yahoo.reuters.com/news/articlehybrid.aspx?storyID=urn:newsml:reuters.com:20060824:MTFH71418_2006-08-24_17-21-43_N24442784&type=comktNews&rpc=44]

HUI Chart & Commentary

Comments: The RSI of the Gold Bugs Index (HUI) collapsed back into the triangle yesterday after briefly hinting at a breakout. The HUI itself is also continuing within the triangle and appears to be testing the lower boundary of the triangle today. I believe that this test should be successful. Stock trading volumes are seasonally the lowest in this week, and it is unlikely that Gold mining stocks will break down out of their triangle pattern on such a low volume day as this. If the HUI does indeed pass the trendline test today, that may set it up for a retest of the upper boundary, as the two trendlines defining the triangle are squeezing together. Although the action in the Gold stocks has been weaker than I expected the last couple of days, I believe the likelihood of bullish breakout within in less than a week remains intact. In fact, in light of the fairly dovish FOMC minutes put out today, which are another signal that the Fed may not only have paused but actually stopped rate hikes, it is entirely possible that today was the last day to load up on gold mining stocks prior to a bullish breakout. Although I have been full invested in my trading portfolio for a little while now, I took the opportunity to buy a symbolic handful of PAAS call options, just to take advantage of this dip.

Portfolio Exposure to PMs: 100% + Call Options

Sentiment: Moderately Bullish - expecting an upside breakout within less than 1 week.

Friday, August 25, 2006

P/Es of HUI and XAU Components

(Data according to Yahoo Finance, during the trading day of August 25, 2006.)

Charts of Interest (TRE / GG / GSS)

- TRE has lagged and now it looks like it may be at around support. After a breakout (in either direction), the measured move on TRE would be around 39%.

- GG is currently in a Triangle pattern. After a breakout, the measured move on GG would be around 25%.

- GSS has outperformed recently but it may soon be headed for a fall with another, steeper bearish wedge developing. A breakdown out of the wedge would lead to a mild fall of $0.2 to $0.3.

HUI Chart & Commentary

Comments: RSI (momentum) looks like it may be confirming its downtrend break. Will the miners follow next week with an upside break out of the triangle?

Comments: RSI (momentum) looks like it may be confirming its downtrend break. Will the miners follow next week with an upside break out of the triangle?

Comments: By the middle of next week it could be a bullseye.

Thursday, August 24, 2006

HUI / Gold Charts & Commentary

Comments: The Gold Bugs Index continues flirting with a breakout from the triangle pattern. RSI momentum indicator has broken its downtrend but has headed sideways since. There are two obstacles to a breakout: (1) Gold seasonality tends to be rather bearish until the first days of September, and (2) because sales have lagged this year considerably below the 500 tonne annual limit under the Central Bank Gold Agreement, it's theoretically possible that increasing quantities could be dumped on the market by Central Banks until September 26, when the limit resets.

Comments: The Gold Bugs Index continues flirting with a breakout from the triangle pattern. RSI momentum indicator has broken its downtrend but has headed sideways since. There are two obstacles to a breakout: (1) Gold seasonality tends to be rather bearish until the first days of September, and (2) because sales have lagged this year considerably below the 500 tonne annual limit under the Central Bank Gold Agreement, it's theoretically possible that increasing quantities could be dumped on the market by Central Banks until September 26, when the limit resets.

Tuesday, August 22, 2006

Iran's Counter Offer

It appears that markets are obsessed with the Iranian counter proposal submitted today in response to the package of incentives offered to Iran by certain Western countries to encourage (coerce?) Iran to cease uranium enrichment activities. It is unclear what the details of the counter proposal will be, however, it will likely take a little time for it to be digested and understood. In the meantime, the price of Gold may drift up and down, possibly forming a "doji" today on the candlestick chart. That would be acceptable as yesterday's breathless climb in the Gold Bugs Index seemed a bit out of proportion with the rise in the price of Gold.

The following seems to be clear regarding the Iran situation:

1. In addition to having a coastline along the strategically critical Hommuz Strait, Iran has the 3rd largest oil reserves in the world [http://upload.wikimedia.org/wikipedia/en/d/d1/World_Oil_Reserves_2005.png]

Thus, Iran is in excellent position to threaten to disrupt oil flows to the world markets, if they were to so choose.

2. Iran effectively faces the enticing prospect of possible regional power vacuums due to the removal by the U.S. of its traditional enemies, the secular but Sunni-leaning Hussein regime in Iraq and the Sunni Taliban in Afghanistan.

3. Although the outcome of the Hezbollah/Israel conflict was militarily ambiguous, the result of the conflict was that the image of the Israeli Defense Force as being invulnerable was badly shaken, which may make Israel tentative for some time in asserting its own and U.S.-driven agendas in the region.

4. It is unclear to what extent China, Russia and France share the U.S.'s commitment to putting pressure on Iran.

5. By setting its own deadlines and putting together its own "new formula" proposal, Iran is taking a proactive stance in these "negotiations" and has made it clear that it will not be intimidated or cajoled into accepting any terms which it deems "unfair". That is, "unfair" in light of the realities mentioned above.

Accordingly, while it is unlikely that Iran will reject outright the package offered by the Western countries, it is also likely that that Iran's counter offer will drive a hard, maybe impossible bargain for the West to swallow. Thus, the most likely outcome of the Iran issue will sooner or later be probably bullish for Gold.

Sunday, August 20, 2006

PAL - North American Palladium, Ltd.

Comments: North American Palladium's (PAL) Lac des Iles Mine is Canada's only primary producer of platinum group metals. The sell off in PAL may be nearing an end. The RSI downtrend has been broken and the selling appears to be driving PAL into a falling (bullish) wedge. A downtrend break appears imminent, followed possibly by a rally in the coming weeks to $8 or $9. Although this stock may be too volatile for investment purposes, it does provide decent trading opportunities from time to time.

Some of the bullish arguments in favor of Palladium are as follows:

- Historic Ratio: The historic ratio between Platinum and Palladium has been about 3 to 1. Currently, the ratio is 3.63 to 1. If Platinum maintains its lofty valuation, Palladium may play catch up.

- Demand: The main sources of demand for Palladium are the automobile industry, where it is used in autocatalysts, and jewelry. Although Palladium was in a supply surplus last year, the bullish argument in favor of Palladium revolves around its substitutability for other precious metals. Car manufacturers may increasingly switch from Platinum to Palladium when manufacturing autocatalysts, due to the lofty price of Platinum and, with Gold and Platinum jewelry being too expensive for many, Palladium may be a natural substitute. The latter argument makes sense to me and I can imagine Palladium soaking up a lot of the lost Gold jewelry demand if investment demand in Gold really surges. Anecdotally, I've noticed quite a lot of media attention being given to Palladium's use in jewelry recently. Have you?

- Supply: With 2/3s of the world's Palladium reserves in one country (Russia), supply disruptions are always possible and have occurred within the last few years.

Related Articles:

[http://www.assetstrategies.com/palladium/index.html]

[http://www.thestreet.com/_yahoo/pom/pomrmy/10304698.html?cm_ven=YAHOO&cm_cat=FREE&cm_ite=NA]

Saturday, August 19, 2006

HUI & XAU Component Earnings (Q2 '06)

HUI Chart & Commentary

(click on the chart to enlarge)

Commentary: As anticipated, the Gold Bugs Index is showing a potential reversal off the uptrend line and the 50 day moving average. Although the RSI uptrend since late June has been broken, the short term RSI uptrend since the August 24 bounce is still intact. Gold successfully tested $610 on several occasions late last week and avoided a breakdown so far. In the next few days, the August 22 (Tuesday) deadline imposed by Iran for its response to the anti-nuclear incentives package and the August 31 deadline imposed by the UN Security Council for Iran to cease enrichment activities may figure prominently in determining the direction of Gold and Gold stock prices until the end of the month hopefully ushers in the seasonal increase in physical Gold demand.

Conclusion: Friday may have been a good time to jump back into Gold and Gold stocks though Monday may yet offer a similar opportunity. Chance for short term upside reversal from here is good, but need to watch for a possible uptrend break since USD Index is not especially bullish for Gold and RSI (momentum) remains below 50 (negative). The HUI uptrend will be at around 325-326 on Monday.

Current PM Exposure: 92% of portfolio (increased from 24% on Friday).

Wednesday, August 16, 2006

HUI Chart & Commentary

Commentary: The recent downtrend break is bullish for the intermediate term. A downtrend break is often followed by a bullish consolidation. In this case, such consolidation appears to be taking the form of a triangle pattern. The very near term (next few days) is bearish however as the RSI (momentum) uptrend break is likely to be confirmed by the uptick today back into the broken trendline.

Conclusion: I would wait and look to rebuy Gold Stocks upon a retest of the bottom ascending edge of the triangle (which today stands at around 323 HUI).

Inflation Confusion (1)

[http://news.yahoo.com/s/ap/20060816/ap_on_bi_go_ec_fi/economy]

The media, in its latest spin, painted the report as a positive since the "core" CPI, which excludes food and energy, rose just 0.2%, after four straight months of 0.3% gains. According to AP economics writer Martin Crutsinger the lower core inflation "was likely to encourage officials at the Federal Reserve, who are counting on a slowing economy to reduce inflation pressures". Although the "core" CPI came in slightly lower than expected, it is worthwhile noting that a 0.2% monthly rate of inflation is 2.4% annualized, which is well above the 1 to 2% range targeted by the Fed.

It is important to remember that traders these days appear to be confused about inflation and its implications for the US Dollar and Gold. In a bizarre twist, during the last few weeks evidence of inflation was seen as being Dollar-positive and Gold-negative as traders focused more on the "cure", i.e., interest rate hikes, than on the inflation itself and its Dollar-destructive implications. During the last few months when inflation reared its ugly head in the official statistics, Dollar bulls harped on the interest rate differentials with other currencies that a Fed response to inflation would likely continue to support.

While it can be expected that this insanity of interpreting inflation as Dollar-positive should sooner or later dissipate, it is at least encouraging that Gold is up today on the news of the milder than expected inflation. At least the market is being consistent in its insanity.

Nevertheless, this "milder than expected" inflation data, combined with yesterday's PPI data which actually showed retreating inflation and the seeming outbreak of peace in Lebanon, may set the stage for some further declines in Gold in the short term. That wouldn't be a problem however as prices may need to fall to entice physical demand back from its recent slumber just in time for the annual "September Rise".

Current PM Exposure: 24% of portfolio.

Sentiment: Wait & See