On October 3, 2006, I received the following response from Rob McEwen, CEO of US Gold Corp., in reply to my e-mail to the company regarding the recent media reports about the activities of Mr. McEwen at the Denver Gold Forum and whether they were helpful or hurtful to USGL. I don't know if Mr. McEwen adequately addressed the issues that I raised, however, I think the fact that he took the time to personally respond indicates that he is sensitive to the issue that I raised.

As indicated in his e-mail, Mr. McEwen also arranged to forward to me the research report from Pacific International Securities which highlights USGL as one of 5 prime takeover candidates among the ranks of the junior explorers. I have included a brief summary of the report below and will post a more in-depth report once I have had a chance to read through it.

October 3, from Rob McEwen, CEO, US Gold Corp.:

"Dear Milosz,

Thank you for your email, via Ana Aguirre. Your question is very relevant. At the Denver Gold Show I made 2 presentations. My first presentation was on US Gold at 9:30 am for 20 minutes, last Monday and the 2nd was billed as the Keynote Speaker at noon of the same day and it was for 45 minutes. The attendance for US Gold was 60-80 people and 270 people at lunch which included many members of the press, thus much more coverage. Since I am the largest individual shareholder of Goldcorp, its founder and opposed to the current Goldcorp bid for Glamis my talk was considered news. The Denver Gold show is a annual gathering of Insitutional shareholders and intermediate and large gold producers. It’s a great audience. We were most fortunate to have a speaking spot, because we are considered a small exploration company that normally would not get to present. I was disappointed by the reaction of the show’s management. I believe I stayed within their guidelines.

I can assure that US Gold moving in the right direction. We have an excellent exploration team, and they are executing our plan to systematically explore our property in search of the next Cortez Hills Discovery. We recently completed to days of tours of our property for analysts and portfolio managers. The feedback from our tours was positive and resulted in one or more research reports or comments. I will ask Ana to forward a copy of Michael Gray’s report ( Pacific International Securities) to you."

The 41 page report by Pacific International Securities, that I received from Ms. Aguirre at USGL, provides an extensive screen of top takeover candidate junior exploration companies with undeveloped gold resources. I haven't had a chance to review it in detail, but I will post the results of my review once it is finished.

Just to summarize the report, Pacific International Securities identifies 15 companies that lie at or near the takeover "Sweet Spot", among which it highlights the following 5 companies as the primary takeover targets:

- Osisko Exploration Ltd.

- Aurelian Resources Inc.

- US Gold Corp.

- Greystar Resources Ltd.

- Miramar Mining Corp.

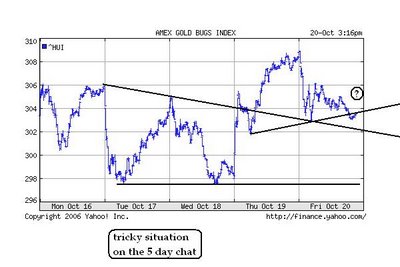

Comments: I was asked by one reader of yesterday's entry titled "Ideas for Energy Trades" about GeoResources, Inc. (GEOI), a natural resources company, which engages in the exploration, development, and production of oil and gas in North Dakota and Montana. I'd have to say that the chart looks risky unless GEOI can regain $6 in a hurry. The most troublesome aspects are a possible sloppy head & shoulders pattern the neckline of which was broken at $6, as well as the fact that there has not been any panic selling washout on high volume. It's all come in drips and drabs, with buyers showing no real effort to reverse the downtrend. I'm bearish on the chart unless it strongly reverses back above $6 .

Comments: I was asked by one reader of yesterday's entry titled "Ideas for Energy Trades" about GeoResources, Inc. (GEOI), a natural resources company, which engages in the exploration, development, and production of oil and gas in North Dakota and Montana. I'd have to say that the chart looks risky unless GEOI can regain $6 in a hurry. The most troublesome aspects are a possible sloppy head & shoulders pattern the neckline of which was broken at $6, as well as the fact that there has not been any panic selling washout on high volume. It's all come in drips and drabs, with buyers showing no real effort to reverse the downtrend. I'm bearish on the chart unless it strongly reverses back above $6 .